Supporters of climate litigation are leaning into alternative strategies to extract dollars from the American energy industry. Last Tuesday, Vermont’s state Senate passed a “climate superfund” bill that would fine American energy companies to pay for the effects of climate change. Similar legislation has also been introduced in Maryland, New York, Massachusetts, and most recently California.

The initiative – which is backed by the Rockefellers – is based on the same flawed theories as the climate litigation campaign and ultimately aims to bankrupt the American energy industry.

“Double-Dipping” Into American Energy Producers’ Pockets Without Burden of Proof

At their core, the climate superfund bills are lawfare in sheep’s clothing. Their proponents even rely on the same “polluters pay” rhetoric ginned up by the Center for Climate Integrity to push climate lawsuits. Nearly all of the states that have introduced climate superfund legislation have also filed climate lawsuits.

And, while superfund bills need electoral support (unlike climate lawsuits), they’re hardly democratic:

Climate superfund bills are backed by billionaire activists, attempt to arbitrarily punish hand-picked entities for legal activities that occurred a quarter century ago, and completely avoid any burden of proof.

Bills Rely on Controversial, Untested Activist “Science”

The legislation glosses over a critically important point: how to decide which companies owe what percentage of the “superfund” damages. The bills’ supporters offer a solution: to use the “Carbon Majors Database,” the fringe and biased body of attribution science developed by climate activist Richard Heede specifically for use in climate litigation.

As with nearly every piece of the climate litigation campaign, it all goes back to the 2012 conference in La Jolla, CA which was co-hosted by Heede’s Rockefeller-funded activist group, the Climate Accountability Institute. According to a summary document from the conference:

“Several participants agreed to work together on some of the attribution work already under way, including efforts to help publicize attribution findings in a way that will be easy for the general public to understand, and build an advocacy component around those findings.”

Right there, participants at the conference admitted this research wasn’t in the pursuit of science, but instead to progress their lawfare agenda. The top plaintiffs’ firm leading the effort even acknowledged they would have a “problem” if they could not “link emissions to specific corporate emitters.” Enter Heede.

Apart from the fact that Heede began his research with a predetermined conclusion – that decades of energy companies’ emissions can be calculated and divvied up into shares of blame – Heede’s data and methodology is totally untested and highly controversial.

Don’t just take our word for it. In 2017, Michael Gerrard, the director of the Sabin Center for Climate Change Law at Columbia University and major proponent of climate lawsuits, said that attribution science has failed in court and has serious problems:

“A further level of attribution that some are seeking is to say that particular companies are responsible for a certain percentage of greenhouse gas emissions. That has not succeeded anywhere […] That’s a very, very challenging prospect, particularly since we all know that climate change is the result of the cumulative emissions of millions of emitting sources over more than a century. And so attributing climate impacts to particular companies is very difficult.” (emphasis added)

In 2022, PolitiFact, an independent fact-checking source run by the media nonprofit Poynter Institute, took issue with Heede’s corporate emissions estimates from 1988 through 2018, pointing out that “the timelines aren’t equal, and not peer reviewed,” never mind the fact that Heede’s original dataset claims to track corporate emissions all the way back to 1751.

Politifact also pointed out that Heede’s conclusions are heavily reliant on estimated scope 3 emissions, which are those created when end-use consumers use oil and natural gas:

“Heede also said direct emissions that come from company operations, such as extracting and refining oil, typically account for around 12% of a ‘carbon major’ company’s total emissions. The other 88% comes from the consumption of the products.” (Emphasis added)

This means that by relying on Heede’s data, superfund bills would tax a handful of oil and natural gas companies for the effects of estimated, historical, global emissions caused not just by the companies themselves but also by consumers around the world.

A Bill Only OPEC+ Would Love

Finally, because the superfund bills don’t have jurisdiction to penalize foreign fossil fuel producers, it’s clear that the intended effect is not to solve climate change but instead to “shutdown” the American oil and natural gas industry.

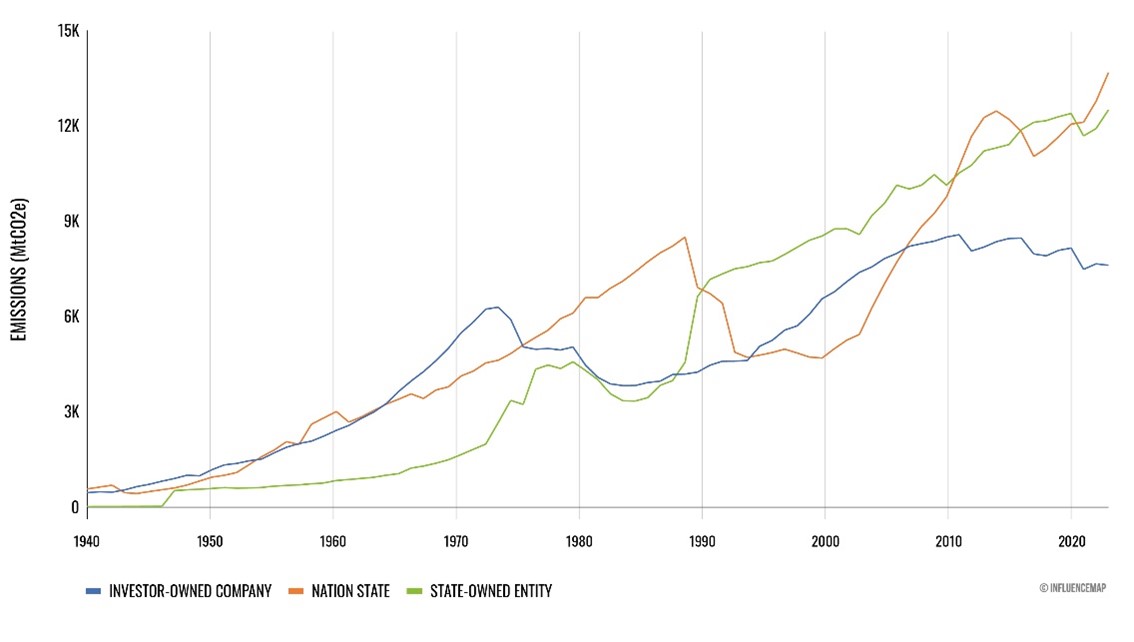

Even Heede’s most recent “Carbons Majors” report acknowledges that emissions from investor-owned energy companies are on the decline while foreign, state-owned enterprises’ emissions are rapidly rising. If real climate action was the goal, wouldn’t it be wise to support the domestic producers that continue reducing global emissions instead of giving a free pass to OPEC+?

Superfund bills wouldn’t just hurt energy security and climate progress – they would also raise costs for American households and businesses. Even a co-sponsor of New York’s stalled superfund bill admitted that it would be “quite naive” to buy into activists’ claims that superfund bills would not have a direct impact on consumers.

Bottom line: Just like climate litigation, divestment, anti-pipeline protests, and other anti-fossil fuel initiatives, superfund bills are yet another billionaire-backed attempt to take down the American energy industry even if consumers have to pay the price.