The New York attorney general’s case against ExxonMobil has been anything but a home run for the state. As Bloomberg’s Erik Larson explained “what was originally advertised as a frontal assault on Big Oil for fueling the planetary climate crisis has—over the years—been transformed into the kind of hair-hurting corporate accounting lawsuit more common to the courthouses just a few subway stops north of Wall Street.” After the first week of trial, Larson added that, “a series of witnesses failed to provide any concrete evidence that the oil giant knowingly misled shareholders about its climate change accounting.” These sentiments have been echoed by multiple media outlets.

As the state wraps up its case against ExxonMobil, let’s review some of the best (and funniest) moments of the trial so far:

#1 350.org’s Failed Climate Protest

In an attempt to capitalize on the media attention at the first day of trial, 350.org attempted to stage an #ExxonKnew protest in front of the courthouse. Maybe it was the rainy weather, or the Tuesday afternoon start time, or maybe it was the fact that this trial has absolutely nothing to do with #ExxonKnew. Needless to say, the organization struggled to rally more than a couple dozen activists around the state’s weak-at-best case against the company:

#2 The NYAG’s Immaterial First Witness

During cross examination, activist shareholder Natasha Lamb admitted that neither she, nor her company Arjuna Capital, own any Exxon stock – undermining any credibility she had to speak to whether the company misled investors. To make matters worse, the organization’s only two shareholding clients do so for the purpose of submitting shareholder proposals or tax purposes.

Then – much to the displeasure of the court, after failing to prove materiality, the NYAG attempted to question Lamb as if she was an expert witness:

THE COURT: I just want to understand the evidentiary significance of what’s being offered here. This is [Natasha Lamb’s] recitation of what Goldman Sachs and some third person is saying?

BERGER: Well, it’s research that this witness did and materials that this witness read in sort of forming her opinion and asking questions that she —

THE COURT: But she’s not an expert witness, she’s not an expert witness.

BERGER: Understood.

THE COURT: She’s a fact witness —

BERGER: Understood. I understand.

#3 The NYAG’s close call

At the end of the first week of trial, the NYAG’s office failed to have their next witness on hand after ExxonMobil finished its cross examination, leaving a significant amount of time left in the schedule. This marked the second time during trial that the attorney general’s office was unable to continue with live witnesses. Justice Ostrager made it clear that he would rest the AG’s case prematurely if it happened again.

THE COURT: …But going forward, if you don’t have a witness ready to go, you rest.

WALLACE: Meaning I will rest my entire case if I do not have another witness lined up?

THE COURT: If you don’t not have a witness available at the conclusion of a witness’s testimony, you rest. It is your obligation to coordinate and see to it that we’re occupied from 9:30 to 4:30, excluding lunch breaks and morning and afternoon breaks.

Justice Ostrager added,

THE COURT: Look, I’ve been doing this for 40-plus years, and you have a contingency plan. You don’t know when opposing counsel is going to elect not to cross-examine the witness because it is entirely possible that the testimony you adduce from a witness that you call requires no cross-examination because it is of no relevance to the case.

#4 Witness Undercuts Key Tenet of NYAG’s Case

In a videotaped testimony played for the court, Roger Read, a senior energy analyst at Wells Fargo, testified that the New York AG’s investigation did not impact his analysis or rating of ExxonMobil. This revelation undermined a core argument of New York’s case, namely that investors and analysts believed ExxonMobil was overvalued because of climate risks.

Q: Do you have any recollection of adjusting your stock rating for ExxonMobil as a result of the New York Attorney General’s investigation?

A: We did not.

Q: Do you have a recollection of adjusting your target price for ExxonMobil as a result of the New York Attorney General’s investigation?

A: We did not.

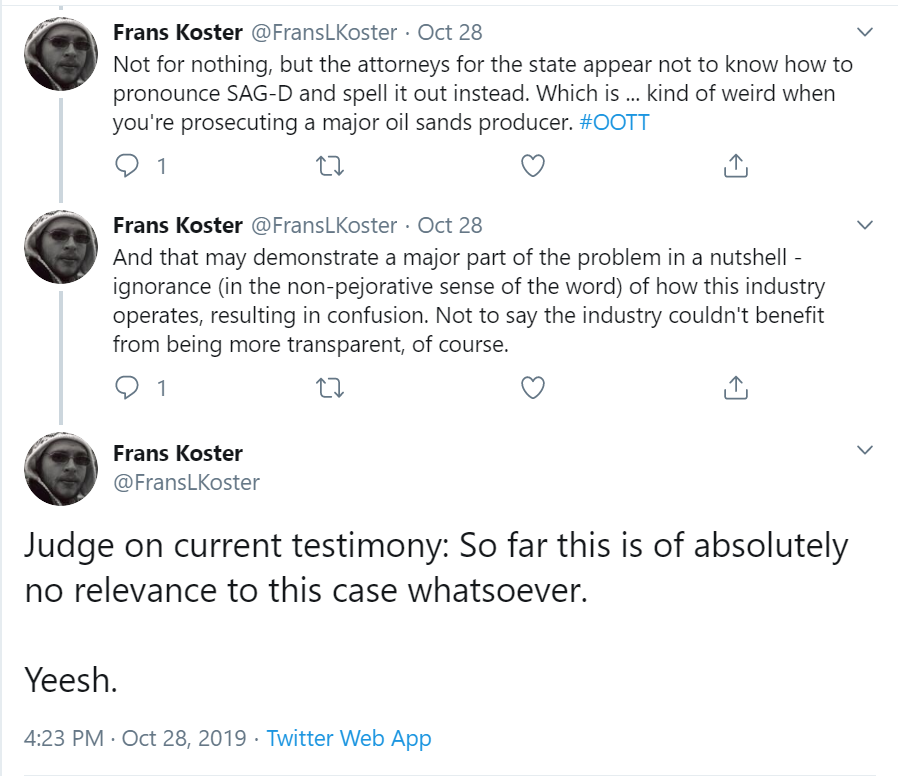

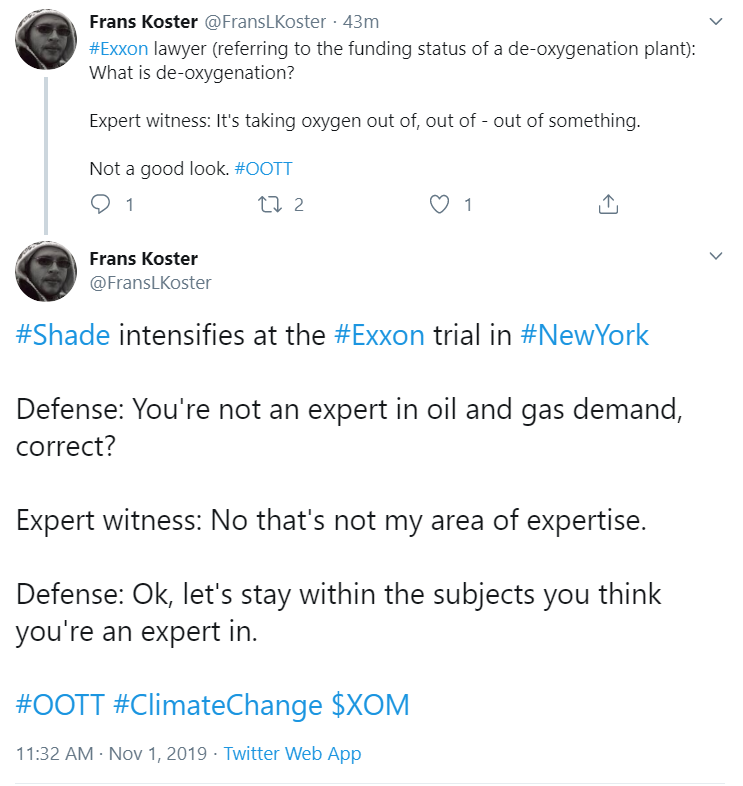

#5 This Reporter’s Live Coverage from Inside the Courtroom About the NYAG’s Questioning and One of Their ‘Expert’ Witnesses.

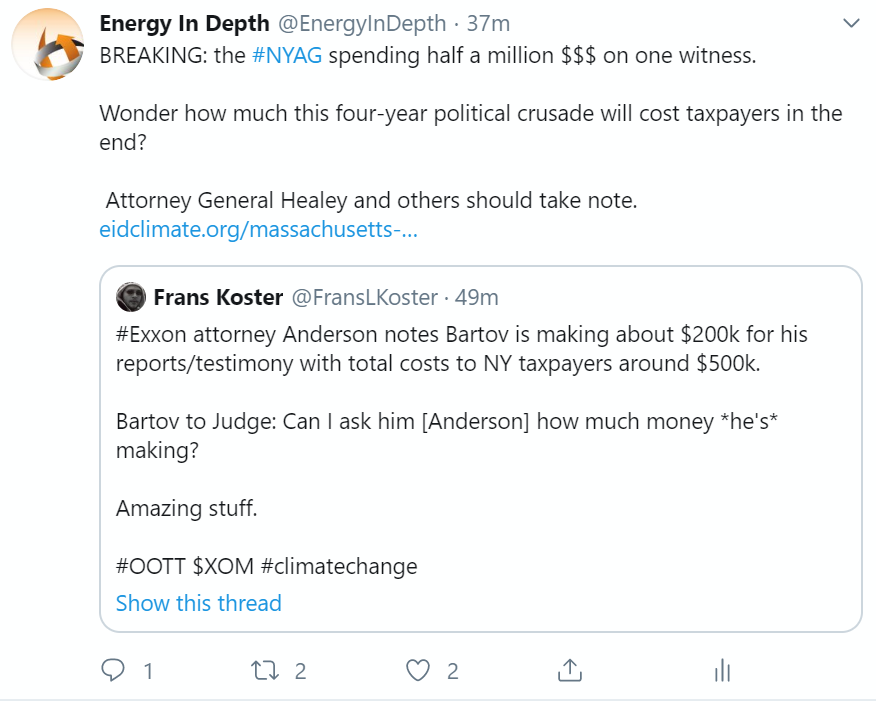

#6 A Taxpayer’s Nightmare

During questioning, one of the NYAG’s expert witnesses admitted to receiving hundreds of thousands of dollars to testify – at no less than a half a million dollars cost to New York taxpayers. After four years of investigating ExxonMobil, we shudder to imagine the final bill when all is said and done.

#7 A “Teaching Exercise” for the State

While questioning one of his expert witnesses, the state’s assistant attorney general struggled to adequately lay the foundation for his questioning. Fortunately, Justice Ostrager was able to step in with some helpful corrections:

THE COURT: Mr. Zweig, we are going to have to start over. Because you have a expert witness here; he is testifying with respect to hypotheticals; hypothetical assumptions that you have asked him to make. So, for example, if pigs had wings they could fly. So, in order for me to understand his testimony, I need to understand the assumptions that he was making in order to reach his conclusions. His conclusions without understanding the basis of his assumptions is of no assistance to the court whatsoever.

And again, shortly thereafter…

THE COURT: This isn’t a teaching exercise here. This is an important trial.

ZWEIG: Yes, your Honor.

THE COURT: So you need to lay a foundation for the questions that you ask.

#8 Climate Progress

Amidst the noise, on the most high-profile day of trial, Rex Tillerson took the stand to highlight the company’s leadership in gauging climate risk and investing in innovative technologies to combat climate change. Much to the disappointment of climate activists, the debunked Wayne Tracker controversy wasn’t given the credence of even a single mention within the courthouse.

WELLS: In terms of the most pressing problems you faced as the CEO of ExxonMobil during that ten-year tenure, how would you rank the issue of climate change?

TILLERSON: Well, we took the issue quite seriously. We recognize the risk of climate change, and we recognize that it was becoming increasingly important to society, more broadly, and that policymakers and legislators were going to be responsive to their constituents into the concerns of society, and they would begin to want to find ways to mitigate, if not reverse the effects of climate change… I wanted to put in place more than just talking about the fact that we knew it was serious and we knew it could affect us. We need to start putting in place a system, a process by which we would actually deliberately think about this every year and begin to help our organization and cause our organization to always think about it at their level.

During his testimony, Tillerson also commended the Paris Climate Agreement, highlighting its global reach, and spoke about his support for a carbon tax:

TILLERSON: We looked at what are other alternative mechanisms to influence people’s choices and we felt a carbon tax was the most simplistic…It’s straightforward. It’s transparent. And then by putting it in place, you then let the market – because now you’ve imposed this cost. You let the marketplace decide, what do we like best?